Monday night, our Council members will take a tour of the Enterprise District (or the portion thereof known as “Site B”) at Alameda Point.

Afterwards, they’ll hold a meeting at the Ron Cowan WETA facility, aptly – but, under the circumstances, perhaps ironically – named for the City’s most successful real-estate developer.

Unfortunately, the meeting won’t be televised, but it is the Merry-Go-Round’s fond hope that, at the end, Mayor Marilyn Ezzy Ashcraft will take the microphone and answer one question:

Just what the hell are the City’s plans for this portion of the former Naval Air Station anyway?

At this point, it looks like original “vision” of the Enterprise District as a place where newly constructed commercial buildings will pay for infrastructure, create jobs, and generate tax revenue may be history. But the City has gone through so many development strategies since then that it’s hard to say what the current strategy is – or what it will become in the future. Please, Madam Mayor: If you can find out, tell the rest of us.

The story of planning for commercial development at Alameda Point really begins in 2011, when the Livermore Berkeley National Laboratories solicited bids for a “second campus” in the East Bay. The campus was intended to consolidate about 480,000 square feet of laboratory and office space; ultimately, it would include about 2 million square feet of research and development facilities.

The Alameda Reuse and Redevelopment Authority submitted a response to LBNL’s RFQ that proposed building the second campus on 45 acres located on the western side of what is now the Enterprise District. LBNL selected the ARRA proposal as one of six “short-listed” for the project, but, despite what the Alameda Journal described as an “aggressive public relations campaign,” Alameda lost out to the city of Richmond.

But out of the experience came an opportunity: Newly appointed City Manager John Russo had been negotiating with the U.S. Navy for a “no-cost conveyance” of the 45 acres needed for the LBNL campus. During those talks the Navy professed willingness to convey to the City – for free (subject to certain conditions) – all 918 acres covered by the Economic Development Conveyance agreement entered into in 2000. It was an offer Mr. Russo could not – and did not – refuse.

And so the planning process began.

The first major step was preparation of a Conceptual Planning Guide that laid out the land uses for the entire site. As the map below shows, the Guide divided the Point into four “sub-areas”:

The “Enterprise Sub-Area” is the area shown in blue at the bottom right of the map. It “provides approximately 107 acres of land for new high-quality research and development, industrial, manufacturing and office uses,” the Guide stated. In addition, it “provides opportunities for new construction to accommodate modern uses and specialized industry needs in high quality, well-designed buildings.”

According to the Guide, “uses in this area are primarily focused on creating a thriving employment center.” Potential uses “range from executive and/or research and development offices to maritime wholesaling and manufacturing to light industrial.” The Guide even provided a “conceptual drawing” of what a fully developed Enterprise District might look like:

After Council endorsed the Conceptual Planning Guide, City staff, led by Mr. Russo and Alameda Point Chief Operating Officer Jennifer Ott, presented a “disposition strategy” to a joint meeting of Council and the Planning Board in September 2013. The top two priority items were to attract “major retail and/or business-to-business sales tax generators” to the Enterprise District and to “[a]ctively market property for a major campus user that generates jobs and/or significant business spin-off potential” within the Enterprise District (and elsewhere).

Attracting a “major retailer” or B-to-B company would lessen the “leakage” of sales-tax revenue from Alameda to other jurisdictions, Mr. Russo and Ms. Ott argued. Likewise, luring a “major employment user” to the Point would provide “numerous benefits,” including improving economic opportunities for local residents; minimizing impacts to City services; creating opportunities for Alameda residents to work and live on-island, and generating auto trips in the reverse-commute direction.

Thereafter, in February 2014, Council certified a final Environmental Impact Report that described the Enterprise District using the same language as the Conceptual Planning Guide. The EIR stated that, at build-out, the Enterprise District would contain 2,070,000 square feet of commercial space (up from 800,000 square feet at the time) and provide 3,164 jobs (up from 440 jobs at the time). It also declared that the District would “focus on new job-generating construction opportunities that become available similar to the Lawrence Berkeley National Laboratory (LBNL) 2nd Campus process.”

With all of the planning documents in place, attention turned to getting the former Naval Air Station finally developed into Alameda Point.

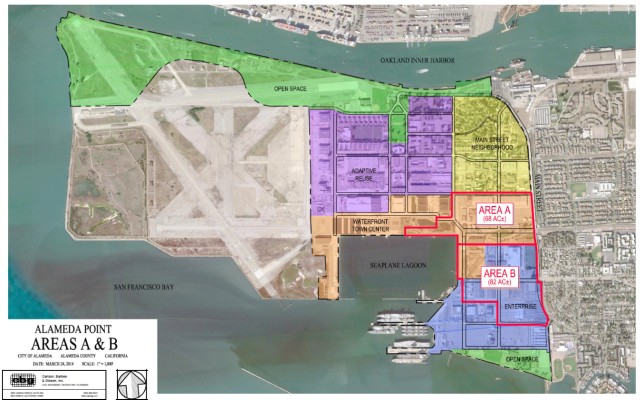

Staff created two discrete developable parcels at the Point: Site A, which contained much of the land in the Waterfront Town Center zoning district, and Site B, which was carved out of portions of the Enterprise and Waterfront Town Center zoning districts. Site A was designated primarily for residential development; Site B was dedicated entirely to commercial development. This map shows the configuration:

Since then, three distinct development strategies have been employed for Site B – and it appears a fourth is waiting in the wings.

Initially, the chosen strategy for both Site A and Site B was to turn the parcel over to a master developer. In May 2014, the City issued an RFQ for Site B seeking “developers/users interested in developing commercial projects with a focus on a major sales tax generator, such as a premium retail outlet (not a ‘big box’ store) and/or a corporate ‘build-to-suit’ user(s) that generates significant jobs, business-to-business sales tax or other catalytic economic benefits.”

In addition to its own project, the developer/user would be required to construct the backbone infrastructure for Site B and to contribute a “fair share” toward the cost of infrastructure for the entire Point. The total estimated tab for backbone infrastructure, development impact fees, and site preparation and grading came to $95.3 million.

The responses to the RFQ weren’t encouraging. Only four firms submitted qualified bids, none of which included a letter of intent from a prospective end-user. Then, after staff had selected two finalists, one backed out. That left three firms, and staff ended up recommending Catellus Development Corporation and Mission Bay Development Group as finalists. According to the staff report, both were proposing “significant” commercial development “with a focus on build-to-suit corporate users, including office/R&D and light industrial uses, and also potentially retail, hospitality and other commercial uses.”

Council approved the recommendation, but less than three months later, staff returned with discouraging news. Neither Catellus nor Mission Bay was willing to make an “upfront commitment to invest funds on infrastructure or land payments or to adhere to a performance milestone schedule,” the staff report stated. Instead, both firms wanted an exclusive development agreement, initially with a 15-year term, then, after staff objected, a three-year term. That wasn’t what the City planners had in mind.

According to the staff report, both finalists cited the “the uncertainty of the market for new commercial development at Alameda Point and the high cost of infrastructure” as the reason for their reluctance to meet the City’s terms. Moreover, both stated that attracting a corporate “build-to-suit” user posed a “significant challenge” because Alameda Point was a “less desirable” location than San Francisco and because it lacked an “attractive ‘gateway’ and amenities for employees.”

The latter drawback, staff suggested, would diminish once the initial stages of the development of Site A had occurred. Indeed, in staff’s view, “Site B is unlikely to garner substantial investment interest until amenities such as those contemplated in the Site A plan are well on their [way] to fruition.” In the meantime, staff recommended deferring any decision about Site B.

Council approved the Site A deal with Alameda Point Partners in July 2015, and the effort to develop Site B entered its next phase.

“Now that there is more certainty about Site A, including its schedule and commitment towards key infrastructure improvements,” staff told Council in October 2015, a “new development strategy” should be adopted for Site B. The new approach would not abandon the prior commitment to new construction (which would fund site-wide infrastructure and pay property taxes) rather than reuse (which would not). Nor would it give up the previously (and repeatedly) stated goals of creating jobs and generating sales-tax revenue. Instead, staff proposed changing the emphasis from seeking a master developer to attracting a “major commercial business or ‘end user’.” Such an approach, the staff report stated, “has the potential to cast a wider net without foreclosing any opportunities.”

The new strategy was to be implemented by Cushman & Wakefield, the real-estate brokerage firm already in charge of leasing space in the existing buildings at the Point. The marketing effort would comprise three stages tied to the status of development at

Site A – an “awareness phase,” a “connection phase,” and a “delivery phrase” – and Council would get progress reports every six months.

Council approved the new strategy in October 2015. Since then, it has received three progress reports. The first two were delivered in June 2016 and October 2016 and were virtually identical. They stated that, by May 2016, Cushman & Wakefield had completed all but one of the “deliverables” in the “awareness” phase, which consisted largely of contacting other commercial real estate brokers and identifying potential corporate end-users. According to the last report, which was delivered in February 2017, the brokerage firm continued to work on the same list of “deliverables” through the end of 2016.

The summary prepared by Cushman & Wakefield set forth two subsequent sets of “deliverables,” but what the brokerage firm actually has done since December 2016 hasn’t been reported. (In any event, we haven’t seen the streaming video of Site A infrastructure work or read the “Enterprise Newsletter” that the summary leads one to expect in phase two.)

This much is clear: No major – or even minor – commercial business or end-user has shown up with an offer to buy all, or any, of the land in the Enterprise District and to construct new buildings there. Instead, it appears that, without any explicit acknowledgement of a change in direction from Council, staff (and Cushman & Wakefield) have shifted to an ad hoc development strategy for Site B that doesn’t pay for all of the site-wide infrastructure or generate property-tax revenue: leasing existing structures for adaptive reuse.

The first such lease occurred in January 2017, when Council approved leasing Building 397 to an aerospace research and design firm called Astra Space, Inc. The lease was for a two-year term with three one-year options to renew. Astra pays a monthly rent – but nothing for backbone infrastructure.

According to Alameda economic development manager Nanette Mocanu, Astra also is negotiating to lease another existing structure at Site B – Building 360; in the meantime, it is renovating a portion of the building under a license agreement. Building 360 sits on top of an industrial solvent plume, and Ms. Mocanu told us that “the regulators have expressed concern about populating this building without a vapor intrusion plan.” Astra is “working on putting together such a plan” in order to get regulatory approval for a lease.

On the surface, Astra wouldn’t seem to fit the description of the “major commercial business or end-user” the City once said it was looking for. The company is renovating two existing structures in the 82-acre site, not building any new ones. Nor is it clear how many workers it will employ or how much sales tax revenue it will generate. Indeed, the strongest endorsement staff made for the Building 397 lease was that it “hopes” Astra could become “a catalyst for other similar companies.”

Staff was ready to present a lease for another existing building at Site B – Building 530 – to Council in October 2018, but the agenda item was withdrawn at the last minute. On April 2, another lease for Building 530 was placed on the consent calendar, this time with a different tenant. (A decision was deferred until the site visit.)

The prospective lessee, Nautilus Data Technologies, is proposing to convert Building 530 into a “water-cooled data storage facility.” The proposed lease is for a 15-year term with two five-year options. Nautilus will pay monthly rent, plus a total of $1,562,971 in installments over 25 years in lieu of a development impact fee.

Again, the Nautilus transaction doesn’t comport with the previously stated strategy of selling land for new commercial construction. As a lessee, the company won’t be paying property taxes, and, as staff concedes, its installment payments amount to only 40 percent of the DIF for which a buyer would be liable. Nor is staff promoting the deal as creating jobs or generating sales-tax revenues. Indeed, the staff report recognizes that data storage “has not been an industry that meets the base redevelopment overall goals for job and sales tax generation.” (In fact, the renovated building will be home to only 30 employees at build-out.)

Unable to cite any of these benefits, the staff report recommending the Nautilus lease advances other arguments calculated to appeal to individual Council members. The data-storage center will be a “green energy” business – which Mayor Ashcraft and Vice Mayor John Knox White undoubtedly will like. In addition, the tenant improvement work will provide 100 union construction trade jobs in the first two years and 50 union jobs in the three years thereafter– which Council members Jim Oddie and Malia Vella surely will applaud. Finally – there’s something for everybody – operating the facility will produce revenue for Alameda Municipal Power, “which will put downward pressure on future rate increases for all customers.”

One might have hoped that, in preparation for Monday’s site visit, staff would have submitted a report that clarified its long-range plans for developing Site B and the rest of the Enterprise District. Instead, it came up with a report that, frankly, we find perplexing.

On the one hand, staff seems to endorse the current ad hoc strategy of leasing existing buildings for adaptive reuse, even though it will not pay for all of the site-wide infrastructure or generate property-tax revenue. “As a high-tech company, [Astra] has the ability to create a synergy to attract similar businesses and it employs high skill/high wage workers,” the staff report states. “As it commercializes its launch equipment, it will create skilled manufacturing jobs.” By the same token, “Nautilus could be a catalyst business, that on its own does not have a large number of employees, but may be an amenity that will attract other businesses with high wage/high skill employees who might not otherwise locate at the Base, and/or provide a service that will allow existing businesses in the Adaptive Reuse area to take advantage of the data server.”

On the other hand, staff also is asking Council to approve what appears to be yet another short-term development strategy for Site B: authorizing Cushman & Wakefield to begin marketing a discrete 23.9‑acre “stand-alone” parcel, one of four into which staff now has divided the area. (See the map below; the recommended parcel is the southeast block. As Richard Bangert pointed out to us, although the map is labelled, “Enterprise District,” it really depicts only Site B.) Why the brokerage firm has not done so already is not revealed. And, unfortunately, both the targets and the benefits of the latest approach remain unclear.

The 23.9-acre parcel is “an appropriate first phase to be marketed for development,” the staff report says, “either by a land developer, an end-user, or a team that can deliver both the required backbone infrastructure improvements and the commercial users.” That pretty much encompasses the universe of potential third parties.

Likewise, if the 23.9-acre parcel were sold for $1.3 million per acre, the sales proceeds would pay for the backbone infrastructure for that parcel, but only a fraction of the cost of the backbone infrastructure for all of Site B, which now is estimated to be $126 million. Yet “if Astra and Nautilus proceed,” the staff report states, DIF payments “will be made that will help to off-set the total infrastructure cost burden.” You do the math; we can’t.

This latest strategy, the staff report concludes, “will assist the City in prioritizing its efforts to focus on securing a developer/end user that can jump-start commercial development with a development parcel that can support the initial infrastructure improvements and be a catalyst for higher value development in the future.”

To us, this sounds like a lot of buzzwords strung together – we almost said gibberish. It’s too bad that Ron Cowan no longer is around to help us make sense of it all. Ms. Ashcraft, please do your best.

Sources:

LBNL: 2011-05-17 staff report re LBNL

Conceptual Planning Guide: 2013-07-23 Ex. 1 to staff report – Conceptual Planning Guide

Disposition strategy: 2013-09-25 staff report re disposition strategy

EIR: 4a_land_use (final)

Site B RFQ: 2014-09-16 Ex. 3 to staff report (RFQ – Site B)

Rejection of Site B finalists: 2014-12-02 staff report re rejection of Site B finalists

“New strategy”: 2015-10-06 staff report re Site B; 2016-06-07 Ex. 2 to staff report re Enterprise District – marketing strategy

“Progress reports”: 2016-06-07 staff presentation re Enterprise District; 2016-10-04 staff report re Enterprise District; 2017-02-21 staff report re Enterprise District development.2

Leases: 2017-01-03 staff report re Bldg 397 lease (Astra Space); Astra Space_Temp Lic_B360_2019-0109; 2019-04-16 staff report re Bldg 530 lease (Nautilus); 2019-04-16 Ex. 2 to staff report – Form of Lease

Site visit: 2019-04-22 staff report re Site B

Perhaps city staff can use this in their marketing.

Give B a chance!

There are plenty of savvy real estate people around, but the council chooses to ignore them.

The Sierra Club and Golden Gate Audubon Society have both recommended that the city evaluate moving the VA Clinic to the Enterprise District area as part of the current environmental impact report on the VA project now underway. It would require only half the acreage that was offered to the Berkeley Lab for free.

Architectural rendering here: https://alamedapointenvironmentalreport.files.wordpress.com/2019/04/va-alameda-point-architectural-rendering.jpg

Thank You for the informative timeline.