Those Alamedans who weren’t able to stay up after 2 a.m. to catch the end of the live feed, or who later quit watching the video after seven hours, missed what may have been the most significant – and troubling – financial news from the Council meeting that began on November 7 and ended on November 8:

During each of the next five fiscal years, the City will need to spend every dime of additional revenue coming into the General Fund just to pay its increased annual bill to CalPERS for pensions for retired City workers. And even then the growth in revenue won’t be enough to cover the escalation in pension costs.

The reluctant bearers of this bad news were City Finance Director Elena Adair and Mike Meyer of NHA Advisors, the San Rafael-based financial consulting firm hired to give advice regarding the City’s skyrocketing liability for pensions and retiree health insurance (aka “OPEB”).

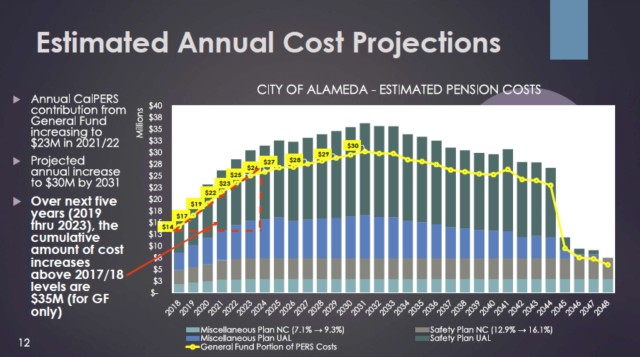

Earlier this year, when Council was considering the new two-year budget, NHA presented a chart projecting the annual amounts the City would be obligated to pay to CalPERS during the next 30 years to provide benefits under the separate pension plans covering public-safety and “miscellaneous” retirees. Since then, CalPERS released updated actuarial reports for the two plans, and NHA revised its projections accordingly – in an upward direction.

On November 7, NHA was prepared to discuss its current forecast with Council, but, given the lateness (or earliness) of the hour, those on the dais decided to go straight to the recommendations. Accordingly, they skipped over the chart below, which, like the earlier one, projected annual pension costs over a 30-year period:

There’s a lot that can be said about these projections and the rest of NHA’s analysis, but we want to focus on the next five years, which is the period for which staff prepares its budget forecasts. Ms. Adair graciously furnished us with the data staff had supplied to NHA for 2017‑18 through 2021‑22, and we used it to compute the annual increases in pension costs.

Here’s the result:

| Fiscal Year | Pension Cost | Annual increase |

| 2017-18 | $13,654,090 | $1,587,686 |

| 2018-19 | $16,068,036 | $2,413,946 |

| 2019-20 | $18,738,250 | $2,670,214 |

| 2020-21 | $21,816,047 | $3,077,797 |

| 2021-22 | $24,783,816 | $2,967,769 |

We then went back to the five-year forecast included in the budget approved by Council in June and asked Ms. Adair to provide us with an updated projection (if staff had done one) for General Fund revenue for the same five-year period. She did so, and we used the data to compute the annual increases.

Here’s that result:

| Fiscal Year | Revenue | Annual Increase |

| 2017-18 | $92,026,000 | $0 |

| 2018-19 | $92,993,000 | $967,000 |

| 2019-20 | $94,421,000 | $1,428,000 |

| 2020-21 | $95,882,000 | $1,461,000 |

| 2021-22 | $97,377,000 | $1,495,000 |

(Note: The five-year forecast actually projects a decrease in revenue in FY 2017-18 compared to the prior year, but since our focus is on increases, we’ve used “0” in the chart.)

Now to the bottom line: comparing the annual pension cost increases with the annual revenue increases. This is where we get the bad news:

| Fiscal Year | Pension Cost Increase | Revenue Increase | Shortfall |

| 2017-18 | $1,587,686 | $0 | ($1,587,686) |

| 2018-19 | $2,413,946 | $967,000 | ($1,446,946) |

| 2019-20 | $2,670,214 | $1,428,000 | ($1,242,214) |

| 2020-21 | $3,077,797 | $1,461,000 | ($1,616,797) |

| 2021-22 | $2,967,769 | $1,495,000 | ($1,472,769) |

Graphically, it looks like this:

So there you have it: if the forecasts are right, the additional revenue coming into the General Fund over the next five years won’t be enough – in any of those years – to pay for the annual increase in pension costs. Indeed, during that period the City will need to find another $7.4 million (the sum of the annual shortfalls) from some other source just to cover the cost increases.

Ms. Adair and Mr. Meyer didn’t lay out all of the foregoing calculations for Council, but there’s no doubt that they understood very well the problem of pension costs rising faster than revenues, sooner rather than later. Indeed, the second part of their presentation – the one the Council members chose to take the time to hear – offered recommendations about how to deal with this problem.

There were two suggestions for the near term. First, the City should take $2 million from the “committed” balance in the General Fund and deposit it into the recently established pension/OPEB trust. (“Committed” means that Council previously has voted to designate funds for a particular purpose, in this case pension/OPEB liabilities.) Among other things, the staff report said, money could be withdrawn from the trust “to defray annual required costs during tough budget years (reducing the amount needed from the General Fund). . . .”

In addition, staff and the consultants recommended that the City take the rest of the General Fund balance previously “committed” for pension liabilities – $6 million – and pay it directly to CalPERS. This “pay‑down,” they explained, would reduce the amount of the City’s unfunded liability (“UAL” to those in the know), which in turn would reduce the portion of the annual payment required to amortize the UAL, which in turn would reduce the size of the check the City would need to write to CalPERS. The staff report estimated that this move would lower pension costs by between $540,000 and $820,000 annually.

Council approved both of the near-term recommendations (but balked at committing a specific amount every year to pay down the unfunded liability). And those actions indeed are likely to narrow the upcoming gap between increased pension costs and additional revenue. But if the forecasts are correct, the $2 million deposited into the pension/OPEB trust will be needed right away, and the $6 million pay-down will produce, at most, a cumulative $4.1 million benefit through FY 2021-22. Even taken together, the two steps thus won’t cover all of the expected shortfall.

Ms. Adair and the City’s consultants made clear that they were recommending only a partial solution to the problem of rising pension costs. “While $8 million is a significant investment,” the staff report concluded, “the City’s future fiscal sustainability and ability to fund critical projects will necessitate further strategies – including other cost reduction measures and/or revenue enhancements.”

On the same page was City Treasurer Kevin Kennedy, who remained till the bitter end of the November 7-8 meeting to offer his views. (City Auditor Kevin Kearney called it quits at 2:15 a.m.) “This absolutely is something the City needs to do,” he said of the staff recommendation. But then, knowing that any future proposals for adding personnel or raising pay would boost the City’s annual pension costs even further, he went on to caution that “we need to be very careful with decisions in terms of staffing, in terms of salary. . . .”

It remains to be seen whether Council, especially one controlled, as this one is, by Council members beholden to the public-safety unions, will heed the message. It is all well and good to vote, as Council did in June, to set aside 50 per cent of any “surplus” – defined as the difference between the ending General Fund balance and the 25% “reserve requirement” – for pension liabilities. But what if there is no surplus? In fact, the five-year forecast projects operating deficits of $2.87 million in FY 2018-19, $5.14 million in FY 2019-20, $7.092 million in FY 2020-21, and $10.527 million in FY 2021-22. In that case, the hard choices identified by staff and Mr. Kennedy become unavoidable.

Unfortunately, the current Council hasn’t demonstrated much of a willingness to hold the line, much less cut back, on spending, especially when the fire department is involved. When former fire chief Doug Long proposed earlier this year to hire three new sworn firefighters to beef up the fire prevention bureau, staff told Council that the proposal would result in cost increases of between $763,916 and $799,206 in FY 2017-18 and between $810,196 and $847,860 in FY 2018-19 (and, thanks to the annual raises guaranteed by the public-safety union contracts, even higher costs thereafter).

This fiscal impact bothered both Mayor Trish Spencer and Councilman Frank Matarrese, who argued that well-trained, but less highly paid, civilian employees could perform the necessary code inspections. But the ruling Triumvirate – Council members Jim Oddie, Malia Vella, and Marilyn Ezzy Ashcraft – brushed such concerns aside. “Safety is our highest priority, and I’m willing to spend public money to support it,” Ms. Ashcraft declared.

Okay, fine. When Ms. Ashcraft runs for mayor and Mr. Oddie runs for re-election to Council next year, we don’t expect to hear either of them proclaim – at least when they think their friends at IAFF Local 689 are listening – that “solvency” now has become their “highest priority.” But, at the least, they ought to tell the voters where they propose to find the “public money” to pay the City’s increased pension bills once all of the additional revenue coming into the General Fund has been used for that purpose.

We’ll be all ears.

Sources:

November 7, 2017 pension cost update: 2017-11-07 staff report re use of reserves; 2017-11-07 REVISED Presentation

June 6, 2017 five-year forecast: 2017-06-06 Ex. 2 to staff report – Budget Summary General Fund and All Other Funds

Fire prevention bureau: 2017-04-18 staff report re adding new positions

A statewide problem: http://www.mercurynews.com/2017/08/10/more-calpers-retirees-are-getting-100000-pensions-according-to-a-new-report/

23,000 CALPers employees X $100,000 pension each = $2.3 Billion, statewide.

Wow! Running this city into the ground … one. day. at. a. time. Stop the pensions and life long benefits. The benefits for these positions are insane. If the city had the money to do it that is one thing, but it doesn’t, so something needs to change. None of us out in the non-city working world get these benefits.